BTC Options Open Interest Surges, Traders Look to an Unfilled Bitcoin Futures Gap at $18K

Bitcoin prices have been volatile during the last few weeks, but have managed to climb higher in value at the same time. This week bitcoin derivatives markets, specifically futures and options, show that crypto asset traders should expect more swings going forward. Some traders believe that the digital currency’s price could fill two unfilled gaps on CME Group’s Bitcoin Futures chart with an upward trajectory toward $18,000.

During the last few days, bitcoin (BTC) spiked over the $16k handle, as numerous cryptocurrency markets have seen some significant gains this week. On Sunday morning, November 14, 2020, BTC’s price slid under the $16k zone to a low of $15,750 during the early morning trading sessions (EST).

The asset has regained some of the lost value and continues to fight the psychological $16k region at the time of publication.

Meanwhile, bitcoin derivatives markets have been seeing some intense action, as both futures and options markets show signs of things to come. On November 6, 2020, Skew.com tweeted about how bitcoin options open interest has been “breaking out big.”

Needless to say #bitcoin options open interest is breaking out big pic.twitter.com/kg084toK6u

— skew (@skewdotcom) November 6, 2020

Essentially, open interest is the measurement of contracts that have been initiated within futures markets held on exchanges like Deribit and CME Group. From Skew’s chart, it shows that BTC options open interest is at an all-time high (ATH), with Deribit capturing the lion share of open interest.

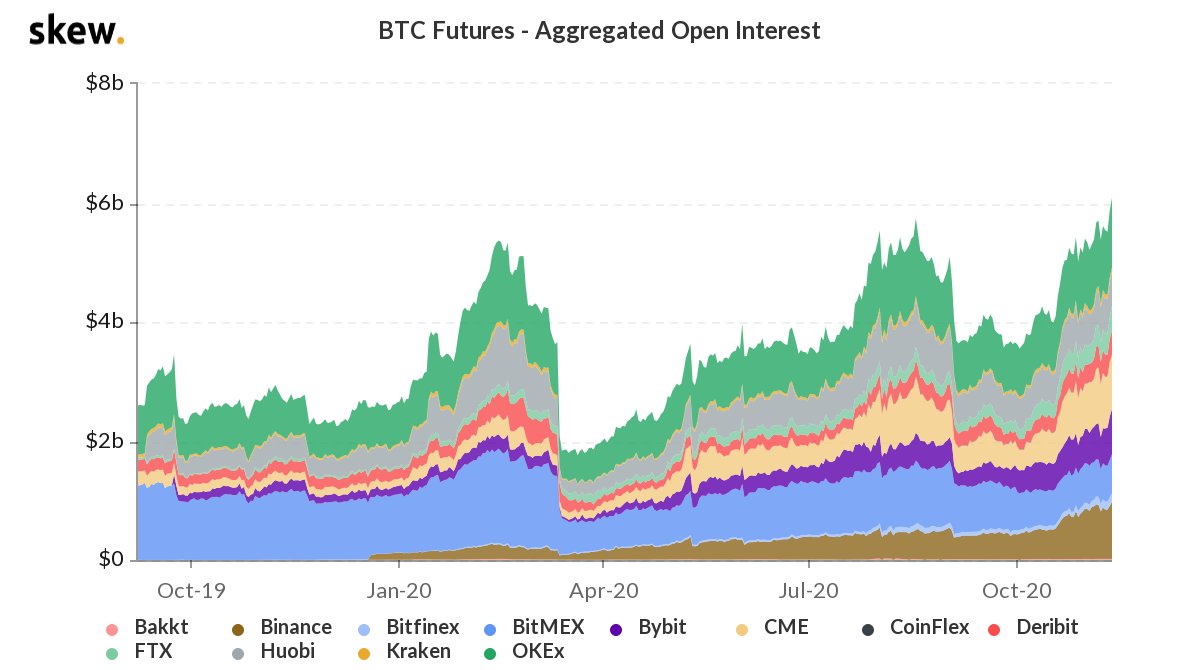

CME Group, Okex, and Ledgerx follow Deribit’s lead, and CME’s open interest has been growing massively. In crypto derivatives markets that tend to bitcoin futures and perpetuals, open interest has also reached an ATH this month.

With Bitmex’s open interest lower since the recent U.S. investigation, most of the derivatives exchange interest is distributed almost evenly except for Bakkt, which is the third-lowest exchange in terms of open interest. Deribit’s also does not lead when it comes to bitcoin futures markets, and Okex commands the leading position in this arena.

In addition to the open interest and trade volumes across bitcoin futures and options markets, BTC traders are eying two specific price gaps from CME Group’s Bitcoin Futures chart. The price gaps which were left unfilled show targets at $17,700 and $18,500 and they stem from BTC’s parabolic rise three years ago.

Gaps can be left unfilled both ways and there are a few lower regions that have been left unfilled on CME Group’s Bitcoin Futures chart. For instance, on May 16, 2019, BTC prices slid to $6,600 in a matter of no time, thanks to an unfilled CME gap at the same level.

Financial markets show that the “filling the gap” process can also happen on the move back toward higher BTC prices. Bitcoin could rise to these positions ($17,700 – $18,500) in order to fill the CME chart’s void and either consolidate, rise higher, or be pushed back to lower price ranges.

Speculative assets, specifically seen on certain CME futures markets, commonly have different variations of price gaps and BTC is no different. On November 6, 2020, BTC filled the gap represented on charts that were recorded on December 21, 2017, at $16,455 to $16,560. There are also two gaps on the downside to keep in mind; one at $11,095 and another at $11,505 as well, which could be just as likely to hit before the $17,700 gap.

What do you think about the recent surge in futures and options open interest and the CME bitcoin futures gaps that could fill in the $18k price range? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

Comments are closed.